Over the last few years, digital applications have been a major game-changer for the financial and banking sector. Gone are the days when consumers had to drive all the way to the nearest bank, stand in long queues, and interact with a bank teller for simple transactions. With the rise in the population of Millennials and Gen Z, digital technology has infiltrated almost every aspect of the customer’s lives, which has essentially paved the way for innovation in the financial domain. From the simple financial transactions of bill payments to the more technical ones like multiple bank transfers, online banking has now become a way of life. Mobile applications, especially in the banking sector, are rapidly becoming a necessity for customers, and so, any disruption in the user experience or a potential security risk could do irreparable damage to the company. Therefore, extensive performance and security testing performed by a bank app testing company is an indispensable step in the application development strategy.

Key Characteristics of the Bank Application

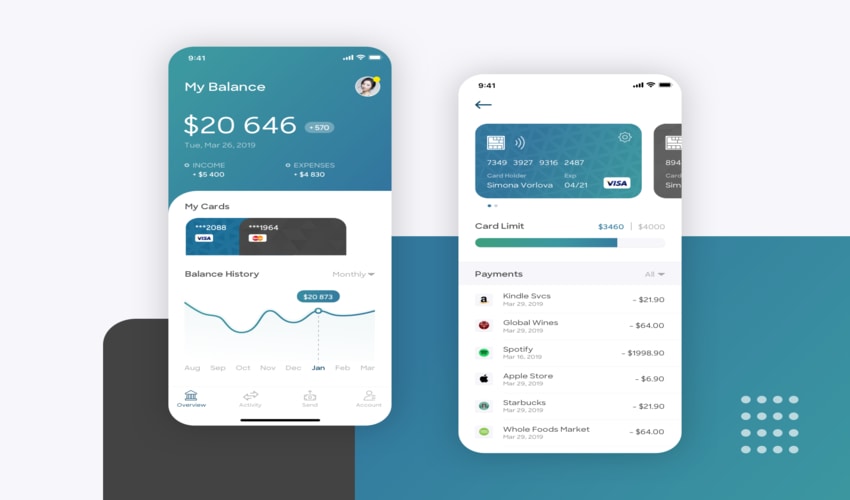

A mobile bank application is more complex than a typical app as it has a multi-layered structure with various domains. For a smooth and satisfactory user experience, the development team and testers have to ascertain that the app can offer a wide range of functions to the users, optimize the security of the applications, and most importantly, have a flexible and enjoyable user interface. For a full-service experience, the predominant characteristics that a banking app should have to comprise of;

– Ability to support large-scale integrations

– Multi-tier functionality to enable the system support of concurrent user sessions

– Complex workflows of the organization

– Batch and real-time processing

– Capability to store massive amounts of data

– Measures for contingencies and disaster recovery protocols

– Robust security measures for user data protection and their transactions

– Ability to support large-scale and high-volume transactions every second

– Resilient auditing infrastructure to troubleshoot any potential customer complaints

– Strong reporting features log and track daily transactions

Building a Testing Strategy for Banking Applications

Providing susceptible information and performing secured financial transactions in a fast, efficient, and user-friendly manner is the fundamental aim of bank applications, and this is primarily why they prove to be more complex. Considering that speed and security are two of the most important goals, the best application testing services providers have become crucial for the seamless execution of the software application. The testers define the testing requirements for the application and build a testing strategy based on that to retain essential feedback from the team and the main stakeholders. For effective implementation of the testing strategy, the team is largely focused on functionality testing to check for smooth user experience, load, and performance testing to gauge if the application is able to handle a large volume of transactions and concurrent user sessions, security testing to measures the application resilience and safety of user data, and mobile testing to ensure that the application functions properly across different devices and platforms.

Tech World Times (TWT), a global collective focusing on the latest tech news and trends in blockchain, Fintech, Development & Testing, AI and Startups. If you are looking for the guest post then contact at techworldtimes@gmail.com